Nvidia (NVDA) stock rose more than 2% Wednesday, stemming losses from a two-day slide that saw shares drop 5% as the AI chipmaker’s annual GTC event failed to excite investors amid a broader market downturn.

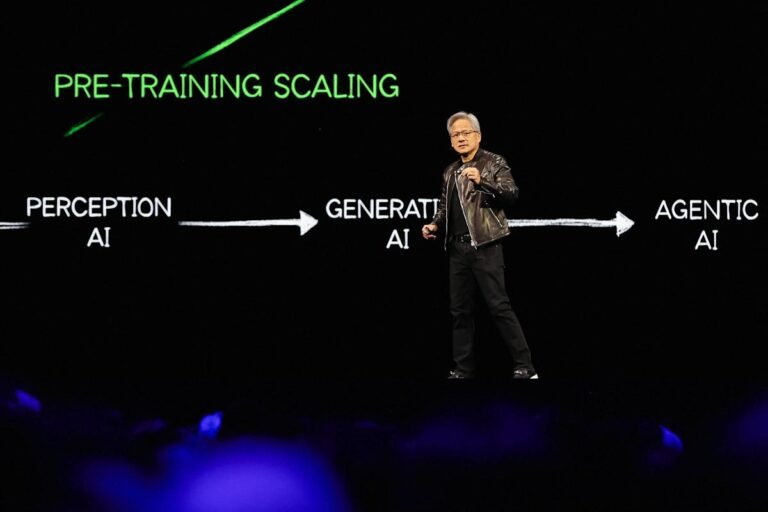

Nvidia stock’s reversal comes as Wall Street analysts walked away from CEO Jensen Huang’s closely watched GTC 2025 keynote Tuesday optimistic about the company’s roadmap and AI demand, doubling down on their bullish outlooks on the chipmaker in notes to investors. Those outlooks counter broader concerns about long-term AI demand and more efficient AI models reducing the need for computing hardware such as Nvidia’s acclaimed GPUs (graphics processing units, or AI chips).

Read more about Nvidia’s stock moves and today’s market action.

At close: March 19 at 4:00:02 PM EDT

“We came out of the keynote reassured in NVIDIA’s leadership which if anything seems to be expanding,” Citi analyst Atif Malik wrote, reiterating his Buy rating on Nvidia stock and $163 price target and calling the chipmaker “king of the hill.”

Raymond James analyst Srini Pajjuri also maintained his Strong Buy rating on Nvidia, echoing Citi’s Malik: “Overall, we walked away comfortable with long term AI demand and continue to be impressed with NVDA’s roadmap & technology innovation.”

Huang laid out Nvidia’s upcoming AI chips during his presentation in San Jose, Calif., on Tuesday afternoon: Nvidia will launch its upcoming AI chip, Blackwell Ultra, in the second half of 2025; its next AI superchip, Vera Rubin in the second half of 2026; and the next-gen superchip after that (Vera Rubin Ultra) in the second half of 2027. Huang reiterated that he sees data center spending on compute hardware (i.e., Nvidia’s total addressable market) reaching $1 trillion.

“I’ve said before that I expect data center build-out to reach $1 trillion. And I am fairly certain we’re going to reach that very soon,” he told a large crowd. During a Q&A session with analysts, Huang added that he expects companies to pour “trillions of dollars” into building what he calls “AI factories,” or colossal data centers dedicated to power artificial intelligence.

“The world is moving from the general purpose computing platform to GPU accelerated computing platform,” he told analysts Wednesday. “Whatever the capex of the world, it is very, very certain that our percentage of that is going to be much higher going forward.”

Bernstein’s Stacy Rasgon wrote in his own note to investors Wednesday morning, “The roadmap looks really solid, and their capability gap vs competitors across their entire massive stack continues to widen.”

Story Continues