(Bloomberg) — Turkish President Recep Tayyip Erdogan is taking steps to ensure protests across the country don’t worsen and to contain a rout in financial markets, even as he turns the screws on opponents.

Most Read from Bloomberg

It looks like he’s succeeding, despite it costing the country almost $27 billion in reserves to defend the national currency.

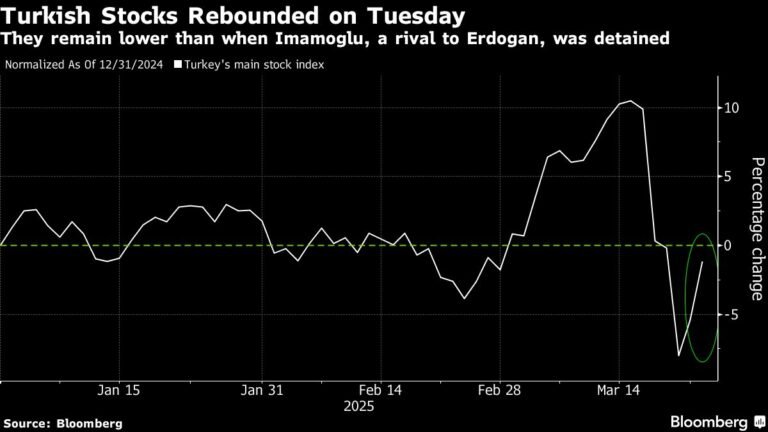

Hundreds of thousands of Turks have taken to the streets daily since the detention of Erdogan’s main rival and mayor of Istanbul, Ekrem Imamoglu, last Wednesday. Yet the demonstrations haven’t reached a point to suggest Erdogan’s position is at risk, and markets rebounded significantly on Tuesday, with Turkish stocks posting the strongest gains globally.

Authorities say they’ve detained more than 1,400 people for “illegal” protests. Still, police are refraining from a severe crackdown of the kind that characterized demonstrations in 2013 and led to widespread international condemnation. The government now hopes the demonstrations will ease as the country heads into the Eid holiday period this weekend, according to senior officials.

In an attempt to sooth market concerns, Erdogan pledged his commitment late on Monday to the investor-friendly economic policies he embraced following his re-election in 2023, which included a hike in interest rates to tame inflation. A day later, Finance Minister Mehmet Simsek, a former Wall Street banker, told investors on a call he would do “whatever it takes” to stabilize markets.

The reaction from investors has contrasted with the tepid response from Europe and the US, with President Donald Trump’s government calling the moves against Imamoglu an internal matter. Trump described Turkey as “a good place” and praised Erdogan as “a good leader” during a meeting with ambassadorial nominees at the White House on Tuesday.

The corruption charges against the mayor, which he denies, might eliminate him from a future presidential election race. He also faces terrorism-related charges for allegedly aiding separatist Kurdish groups.

US Secretary of State Marco Rubio met with Turkish Foreign Minister Hakan Fidan on Tuesday to discuss security and trade, according to a readout by the State Department. Rubio expressed concerns about the arrests and protests in Turkey, it said.

Turkish officials said beforehand that the two could decide on the date of a White House meeting between Erdogan and Trump, probably toward the end of April.

With neighboring Syria in flux after the fall of Bashar Al-Assad and Trump seeking to end Russia’s war in Ukraine, Erdogan is banking that Turkey’s status as the second-largest NATO power will give him cover to pursue his agenda at home. Erdogan wants to buy F-16 and F-35 jets from the US as parts of efforts to bolster his military, Bloomberg has reported.

“Erdogan will bet on voters forgetting about Imamoglu by the next elections, while continuing to focus on improving Turkey’s geopolitical clout and fixing the economy,” said Emre Peker, the London-based Eurasia Group Europe director. Turkey’s role in various conflicts will “shield the Turkish president from international isolation.”

Burning Reserves

The president still has to move cautiously. The protests could grow to an extent his security forces can’t control, and investors could take fright again. Locals could also rush to convert their money to dollars if they lose trust in the lira.

Turkey has already used up a significant chunk of its financial arsenal. The central bank sold $26.6 billion to defend the lira in the last three days of the past week, according to Bloomberg Economics. That reduced its net reserves to $32 billion from $55 billion at the end of January, Bloomberg Economics calculates.

“A pick-up in the pace of dollarization among domestic savers following last week’s market volatility is a key risk,” said Selva Bahar Baziki, an economist at Bloomberg Economics in Ankara. She predicted the bank’s interventions to support the lira would take net reserves to zero by mid-April if the pace of the past week were maintained.

Turkey’s main equities index rose 4.5% on Tuesday, extending Monday’s advance after a 17% drop last week.

The currency stabilized after Erdogan backed Simsek’s economic program. It was trading little changed at 38.0 per dollar as of 6:34 a.m. in Istanbul on Wednesday.

Imamoglu’s detention in a dawn raid came after authorities revoked his university diploma, a must to run for president. An Istanbul court, though, rejected terrorism-related charges against him, which could have prompted the government to appoint a trustee as the mayor of Istanbul.

Imamoglu first won control of Istanbul in 2019. It was an election victory that spelled the end of a quarter-century rule by Erdogan’s AK Party and its predecessors over the city of 15 million people. It also made Imamoglu a national figurehead for the opposition.

–With assistance from Firat Kozok and Ugur Yilmaz.

(Updates with remarks from Trump in 6th and Rubio in 8th paragraphs.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.